The Ultimate Overview to Comprehending Cooperative Credit Union

Debt unions stand as distinct economic entities, rooted in principles of common support and member-driven procedures. Nevertheless, past their fundamental worths, understanding the elaborate workings of credit score unions entails a deeper exploration. Unwinding the complexities of subscription qualification, the evolution of solutions supplied, and the unique benefits they bring needs a detailed evaluation. As we browse with the intricacies of credit unions, an informative journey awaits to clarify these member-focused establishments and just how they vary from typical banks.

What Are Lending Institution?

Credit history unions are member-owned banks that supply a series of banking solutions to their members. Unlike conventional banks, cooperative credit union run as not-for-profit organizations, meaning their key emphasis gets on offering their participants instead of maximizing revenues. Participants of a credit report union usually share a typical bond, such as helping the very same employer, belonging to the exact same community, or being part of the very same company.

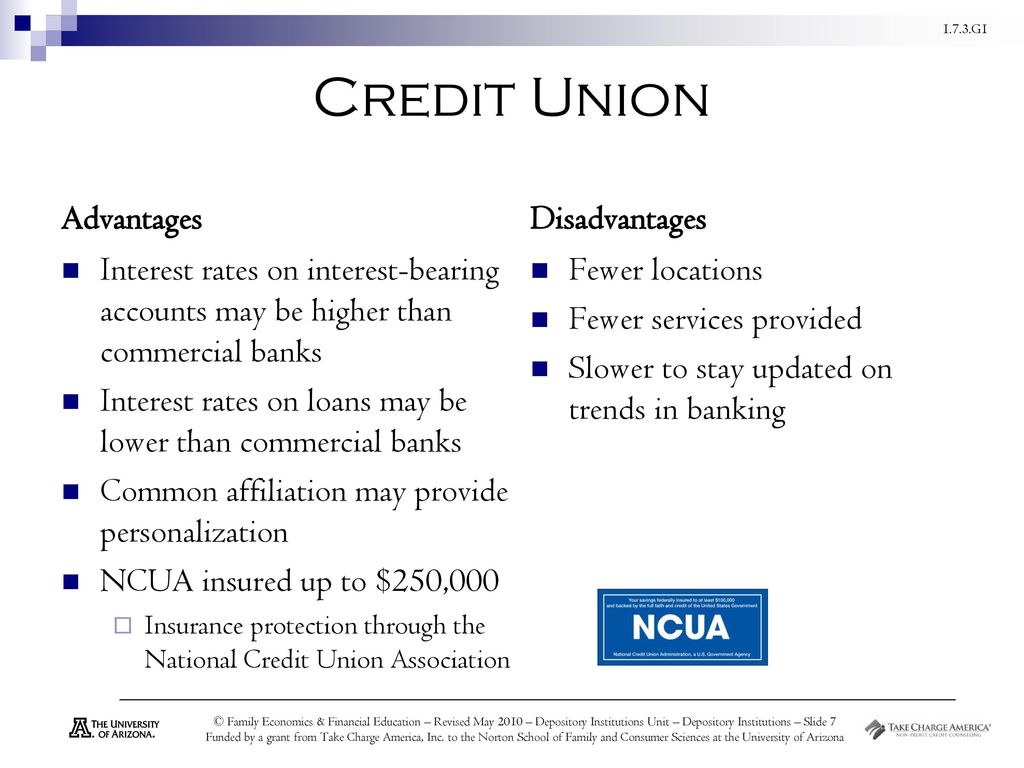

Among the vital advantages of lending institution is that they usually use greater rates of interest on interest-bearing accounts and reduced rate of interest on fundings compared to banks. Credit Unions in Wyoming. This is since cooperative credit union are structured to profit their members directly, enabling them to pass on their revenues in the type of better prices and less costs. Additionally, lending institution are known for their personalized customer care, as they focus on developing relationships with their members to comprehend their distinct financial requirements and goals

Background and Evolution of Lending Institution

The roots of member-owned monetary cooperatives, recognized today as lending institution, trace back to a time when areas sought alternatives to traditional banking organizations. The idea of credit score unions come from the 19th century in Europe, with Friedrich Wilhelm Raiffeisen commonly credited as the leader of the participating banking motion. Raiffeisen founded the initial acknowledged credit scores union in Germany in the mid-1800s, stressing area support and self-help principles.

The development of cooperative credit union continued in North America, where Alphonse Desjardins established the initial cooperative credit union in Canada in 1900. Soon after, in 1909, the initial united state cooperative credit union was created in New Hampshire by a group of Franco-American immigrants. These early lending institution run on the basic concepts of common assistance, autonomous control, and member ownership.

Over time, credit rating unions have actually expanded in appeal worldwide because of their not-for-profit structure, focus on offering participants, and offering competitive economic services and products. Today, lending institution play an important role in the economic industry, supplying community-oriented and easily accessible financial alternatives for services and people alike.

Subscription and Eligibility Standards

Membership at a cooperative credit union is generally restricted to individuals meeting specific qualification requirements based upon the institution's starting principles and regulatory demands. These standards frequently include elements such as geographical location, employment standing, subscription in particular companies, or affiliation with specific teams. Credit scores unions are recognized for their community-oriented approach, which is mirrored in their membership needs. Federal Credit Union. Some credit unions may only offer people who live or function more information in a particular area, while others may be customized to staff members of a certain company or participants of a specific association.

Furthermore, cooperative credit union are structured as not-for-profit organizations, suggesting that their primary goal is to offer their members rather than generate earnings for investors. This emphasis on participant service typically translates into even more individualized interest, lower charges, and competitive rate of interest rates on financial savings and fundings accounts. By fulfilling the see page qualification criteria and coming to be a member of a lending institution, individuals can access a series of monetary services and products customized to their particular needs.

Solutions and Products Supplied

One of the vital facets that sets credit history unions apart is the diverse variety of monetary services and products they use to their participants. Credit history unions typically give typical financial solutions such as financial savings and inspecting accounts, car loans, and credit report cards.

Furthermore, credit history unions frequently offer hassle-free online and mobile financial options for members to conveniently manage their funds. They may supply perks such as shared branching, enabling members to access their accounts at other lending institution across the nation. Some lending institution likewise supply insurance items like vehicle, home, and life insurance to help participants secure their possessions and liked ones.

Benefits of Financial With Lending Institution

When considering economic institutions, discovering the benefits of banking with credit scores unions reveals unique benefits for participants seeking customized solution and affordable rates. Unlike huge financial institutions, credit rating unions are member-owned and focus on building solid relationships with their participants. On the whole, financial with a credit rating union can give an extra individualized, cost-efficient, and member-centric economic experience.

Final Thought

In verdict, credit score unions stand out as member-owned monetary organizations that focus on serving their members over making the most of earnings. With origins dating back to 19th century Europe, credit scores unions follow principles of shared assistance and member ownership.

Credit history unions are member-owned monetary establishments that provide a range of banking services to their his explanation members. The principle of credit history unions originated in the 19th century in Europe, with Friedrich Wilhelm Raiffeisen typically attributed as the pioneer of the cooperative financial activity.The advancement of credit report unions proceeded in North America, where Alphonse Desjardins established the initial credit history union in Canada in 1900. Credit history unions commonly provide typical financial services such as financial savings and inspecting accounts, finances, and debt cards.When considering economic organizations, discovering the benefits of financial with credit rating unions discloses special advantages for members seeking individualized solution and affordable rates.

Comments on “Experience the most effective of Banking at a Wyoming Credit Union: Your Resident Financial Partner”